A Comprehensive Overview to E2 Visa Requirements for Aspiring Investors

The E2 visa offers as a vital pathway for foreign capitalists wanting to develop or invest in organizations within the United States. Comprehending the qualification requirements and financial investment standards is crucial for success. Aspiring financiers have to prepare detailed paperwork to sustain their applications. The subtleties of this procedure can be intricate. What particular steps must one take to assure a desirable result?

Comprehending the E2 Visa: Overview and Purpose

The E2 Visa works as an important pathway for international financiers seeking to spend or develop in an organization within the United States. This non-immigrant visa is developed to assist in trade and investment between the united state and treaty nations. By providing the E2 Visa, the united state government aims to motivate financial development, job creation, and technology with foreign capital infusion. Capitalists can use this copyright manage their own organization or to buy existing business, promoting a business spirit.

The E2 Visa permits investors and their prompt family members to live and function in the united state for extended periods, section upon their investment's stability. The visa is eco-friendly, offered that the business remains functional and meets the needed standards. Generally, the E2 Visa plays a vital role in promoting worldwide service connections while giving international investors with possibilities to prosper in the U.S. industry.

Qualification Criteria for E2 Visa Applicants

To receive the E2 Visa, applicants must fulfill specific eligibility requirements that demonstrate their commitment to purchasing a united state business (E2 visa requirements). The candidate should be a national of a country that holds a treaty of commerce and navigation with the United States. This treaty country status is crucial for qualification

Secondly, the applicant has to invest a substantial amount of funding in an authentic venture. While the specific quantity may differ, it generally has to be enough to assure the effective procedure of business.

In addition, the financial investment must go to danger, meaning it should be subject to loss if business stops working. The candidate needs to also reveal that they have the abilities and experience essential to direct the business and establish.

The E2 Visa is meant for active investment; thus, easy financial investments do not satisfy eligibility requirements. Fulfilling these standards is crucial for an effective application.

Investment Requirements and Guidelines

Financial investment requirements for the E2 Visa are designed to assure that applicants demonstrate an authentic commitment to establishing and operating a sensible organization in the USA - E2 visa requirements. To qualify, financiers should make a substantial investment in a real and running business. While there is no taken care of minimum amount, investments commonly vary from $100,000 to $200,000 or even more, depending upon the nature of the business. The investment should be at threat and committed to the organization, and it should cover first startup expenses, functional expenditures, and the development of tasks for U.S. employees

Moreover, the financial investment should be symmetrical to the total cost of business, making sure that it represents a significant portion of the total economic dedication. The business needs to also be a for-profit business, capable of generating earnings past simple subsistence for the investor and their family members, showing potential for growth and financial payment to the united state economic situation.

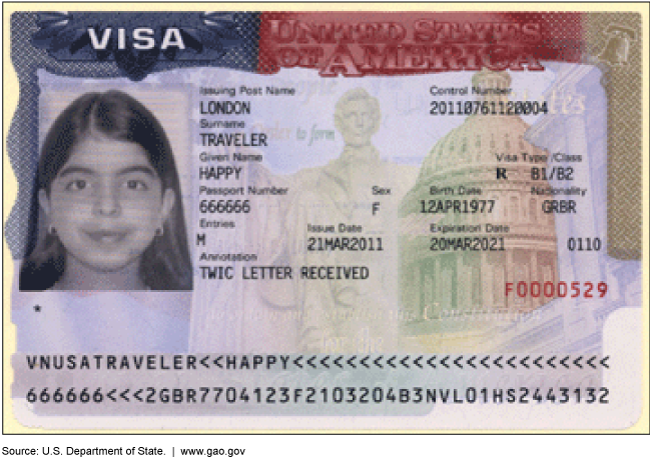

Required Documentation for E2 Visa

Gathering the essential documentation for an E2 Visa is crucial for financiers seeking to establish a company in the USA. Trick records include proof of nationality, which verifies that the capitalist is a resident of a treaty country. A detailed service plan is essential, detailing the operational framework, market analysis, and news economic projections of the intended venture. Investors need to also provide evidence of financial investment funds, showcasing that the funding is significant and in jeopardy in the organization. Financial statements, bank records, and receipts of the financial investment can act as supporting files. Additionally, any lawful papers associated to business, such as lease agreements or unification papers, have to be consisted of. Personal documentation such as tickets, pictures, and a résumé might likewise be needed to complete the application. Effectively constructing these papers lays the groundwork for a successful E2 Visa.

The Application Process: Step-by-Step Guide

Steering the E2 Visa procedure entails numerous crucial actions that capitalists should very carefully follow to ensure a successful end result. Applicants ought to prepare an in-depth company plan that lays out the nature of the investment, the predicted financials, and functional strategies. Following this, collecting essential documentation, such as evidence of mutual fund and proof of the capitalist's over at this website intention to develop and guide the service, is essential.

Next off, investors should complete and send Kind DS-160, the Online Nonimmigrant Visa, in addition to the called for charges. Scheduling a visa meeting at the united state consulate or embassy in their home country is the next action. Throughout the interview, applicants need to offer their paperwork and answer inquiries concerning their organization strategies and investment. If accepted, the E2 Visa will be released, allowing financiers to start their company procedures in the United States. Adhering to these steps raises the likelihood of a favorable outcome.

Frequently Asked Questions

Can Family Members Members Accompany Me on an E2 Visa?

Yes, relative can go along with an individual on an E2 visa. Partners and unmarried kids under 21 are qualified to apply, enabling them to live and examine in the United States while the primary visa holder runs an organization.

How Much Time Can I Remain In the U.S. With an E2 Visa?

An E2 visa owner can remain in the united state for a preliminary period of as much as two years. Extensions are feasible, enabling proceeded residence as long as the investment and business procedures stay energetic.

Exists a Limit on the Number of E2 Visa Renewals?

There is no particular limit on the number of E2 visa renewals. Nevertheless, each revival needs to show recurring service feasibility and conformity with visa requirements, guaranteeing that the organization stays a legitimate financial investment.

Can I Change My Service Kind After Receiving the E2 Visa?

Altering the company kind after obtaining an E2 visa is feasible, but it calls for conformity with certain guidelines. The new business should still meet the investment and operational criteria stated by migration authorities.

What Happens if My E2 Financial Investment Falls Short?

If an E2 financial investment stops working, the capitalist might encounter possible loss of the financial investment and difficulties in maintaining visa status - E2 visa requirements. They must explore alternatives, such as alternate financial investments or going back to their home country

The E2 visa offers as a necessary pathway for foreign financiers looking to establish or spend in organizations within the United States. The E2 Visa offers as an essential path for international investors seeking to invest or develop in an organization within the United States. Financial investment requirements for the E2 Visa are designed to assure that applicants demonstrate a genuine dedication to establishing and operating a sensible organization in the United States. Gathering the essential documentation for an E2 Visa is essential for financiers seeking to develop an organization in the United States. If authorized, the E2 Visa websites will certainly be released, allowing financiers to start their organization procedures in the United States.